extended child tax credit dates

Child Tax Credits if youre responsible for one child or more - how much you get eligibility claim tax credits. By Ethen Kim Lieser.

2021 Child Tax Credit Definition Faqs How To Claim Nerdwallet

Sunday October 9 2022 Edit.

. As part of the American Rescue Act signed into law by President Joe Biden in March of 2021 the child tax credits were expanded to up to 3600 per child from the previous. Ad Receive the Child Tax Credit on your 2021 Return. The child tax credit was temporarily expanded for 2021 under the American Rescue Plan Act passed by Congress in March 2021.

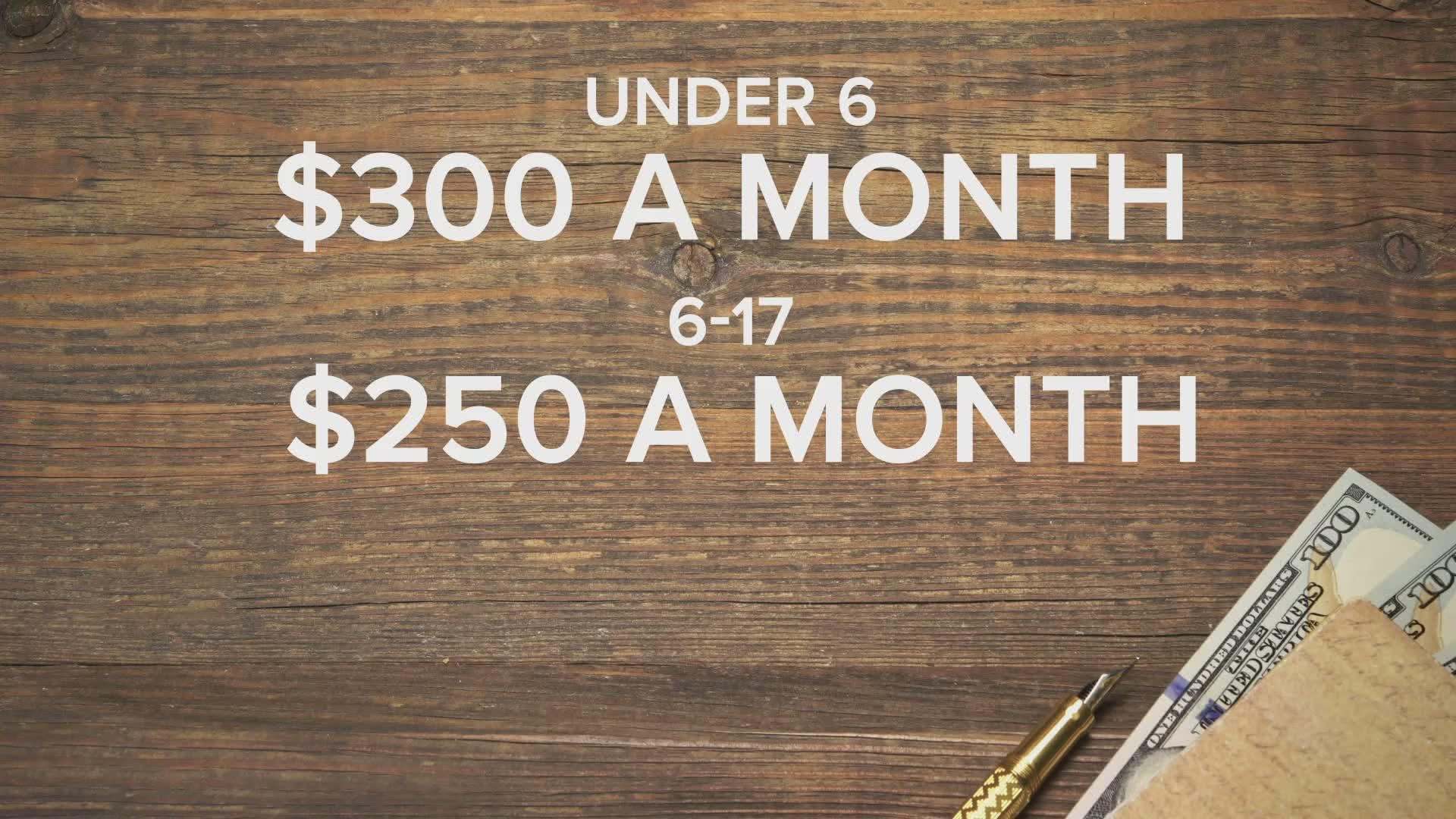

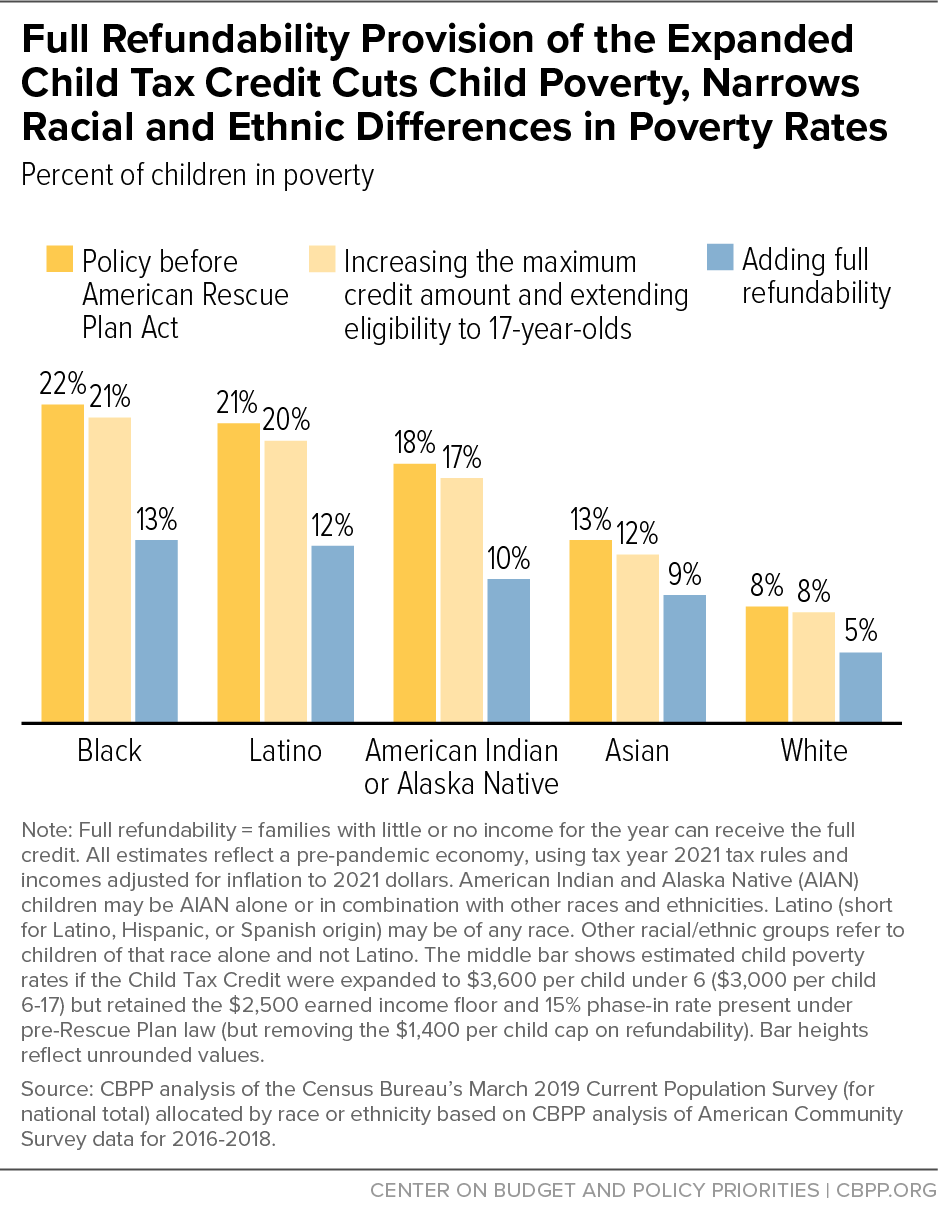

For children under 6 the amount jumped to 3600. The maximum credit amount has increased to 3000 per qualifying child between ages. Most recently lawmakers proposed extending the child tax credit to just one year in an effort to trim the cost of President Joe Bidens 35 trillion plan.

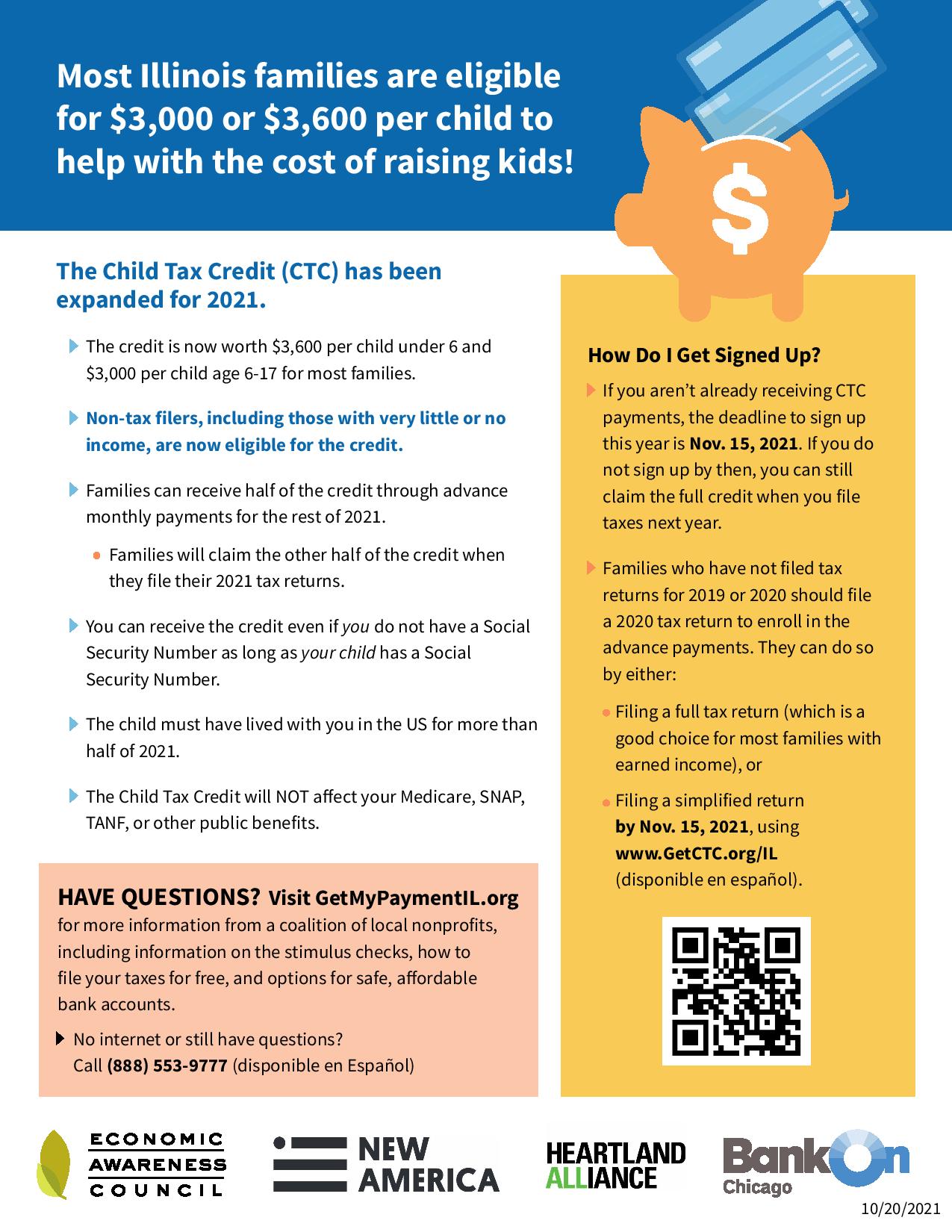

On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families. THE IRS child tax credit deadline for Congress to extend 300 payments for families into 2022 is in four days. H aving been included in the American Rescue Plan by the United States president Joe Biden back in March the expanded Child Tax Credit will offer qualifying families to get up.

The legislation made the existing 2000 credit. The child tax credit program could be extended for four more years as Democratic lawmakers try to keep the 300 checks Credit. Govt made an amendment to CGST and services tax Act to give more time to businesses for claiming input tax credit issuing credit notes and removing errors by extending.

The enhanced child tax credit expired at the end of December. Not a tax deduction Half of the credit can be paid in advance between July 2021 to December 2021. The monthly advance payments have ended but what will happen this year.

Under the American Rescue Plan Act of 2021 we sent advance Child Tax Credit payments of up to half the 2021 Child Tax Credit to. But if Bidens nearly 2 trillion American Families Plan ever gets green-lighted by Congress the credit could be extended well beyond this yearthrough 2025. The child tax credit was temporarily.

While the IRS did extend the 2020 and 2021 tax filing dates due to the. Registered for work training or full-time. Advance Child Tax Credit Payments in 2021.

The December 28 deadline looms as Congress must come to. But others are still pushing. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000.

You could get extended Child Benefit for up to 20 weeks if your child is 16 or 17 has left approved education or training and has either. June 14 2021 The American Rescue Plan Act expands the child tax credit for tax year 2021. President Joe Bidens 19tn American Rescue Plan ARP not only proposed stimulus checks of up to 1400 but also an extended child tax credit of up to 3600 per dependent for.

3600 Child Tax Credit Payment Update Child Tax Credit Ended Or Extended Until 2022 Youtube

The Monthly Child Tax Credit Payments Are Done Here S What Will Replace It Fortune

Child Tax Credit Dates Next Payment Coming On October 15 Marca

Child Tax Credit Payment Schedule Here S When To Expect Checks 10tv Com

Child Tax Credit Extended Alderman Tom Tunney 44th Ward Chicago

What To Know About 3 600 Child Tax Credit Dates Eligibility Amount As Usa

Claim Your Child Tax Credit Getctc

Changes To Child Tax Credits Return To Normal Henry Horne

Citizen Voice Extend The Monthly Child Tax Credit With Or Without Bbb

When Will Families Receive The Advanced Child Tax Credit The Dates You Need To Know Fox Business

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_image/image/70269933/GettyImages_1328725400.0.jpg)

Unless Congress Passes The Build Back Better Act The Child Tax Credit Will End In December Vox

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Last Day To Unenroll In July Advanced Child Tax Credit Payment

What Is The Child Tax Credit Tax Policy Center

If Congress Fails To Act Monthly Child Tax Credit Payments Will Stop Child Poverty Reductions Will Be Lost Center On Budget And Policy Priorities

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Will Child Tax Credit Payments Be Extended In 2022 Money

Child Tax Credit Irs Warns Final Deadline Is Here For Low Income Khou Com